Welcome to the crazy world of betting on English non-league football. All the way down to the tenth tier matches are on the global betting market.

By Steve Menary

The scouts sit at the back of the main stand to avoid attention, usually on the half-way line. They generally buy tickets, so the clubs have no idea they are even there. A young person constantly on their mobile rarely attracts attention. To the hardy mostly older non-league fans around them, they are probably on TikTok or Instagram.

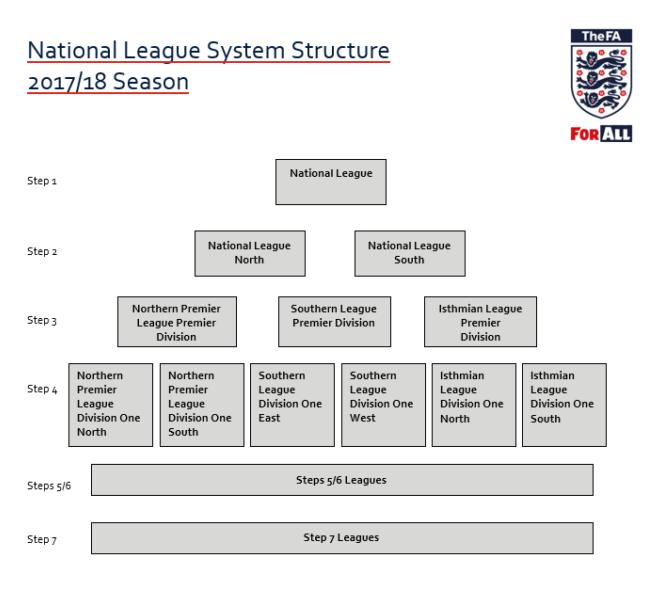

In England, the National League System – often described as non-league – is a pyramid that feeds into the Football League. Steps three and four are collectively known as the Trident Leagues and at the bottom level some games are watched by less than a hundred people.

Yet live in-play betting on games at this level is routinely offered around the world because data collected by scouts from the stadiums is sold to online bookmakers.

Between February and March 2022, more than 120 Trident League games were on international websites ranging from licensed Entain subsidiary Bwin to Georgian company Betlive and controversial operator 1XBet.

For data companies, these matches are attractive as the...