Josh Wander of 777 Partners has been indicted by the DOJ, but what does this mean for A-CAP, their biggest creditor, which has seized most of their assets, football clubs included, and remains accused of being the “puppeteer” pulling their strings?

By Paul Brown and Philippe Auclair

While Josh Wander (lead photo, left) was putting his condo up to cover a 15 million dollars bail bond after being indicted on criminal fraud charges last month, A-CAP’s Kenny King (lead photo, right) was in the process of buying one in Manhattan for almost 9 million dollars.

For those of you who are new to this story, Wander is the brash playboy head of 777 Partners who has fallen on hard times and was charged on 16 October by the US Department of Justice (DOJ) for engaging in a scheme to defraud lenders out of more than 500 million dollars.

And King is the founder and CEO of A-CAP, a New York investment firm which owns five US insurers and is accused of being “the puppeteer to the 777 Partners’ marionette” in the bombshell civil lawsuit which sparked the beginning of the end for Wander and his company when it was filed in May 2024.

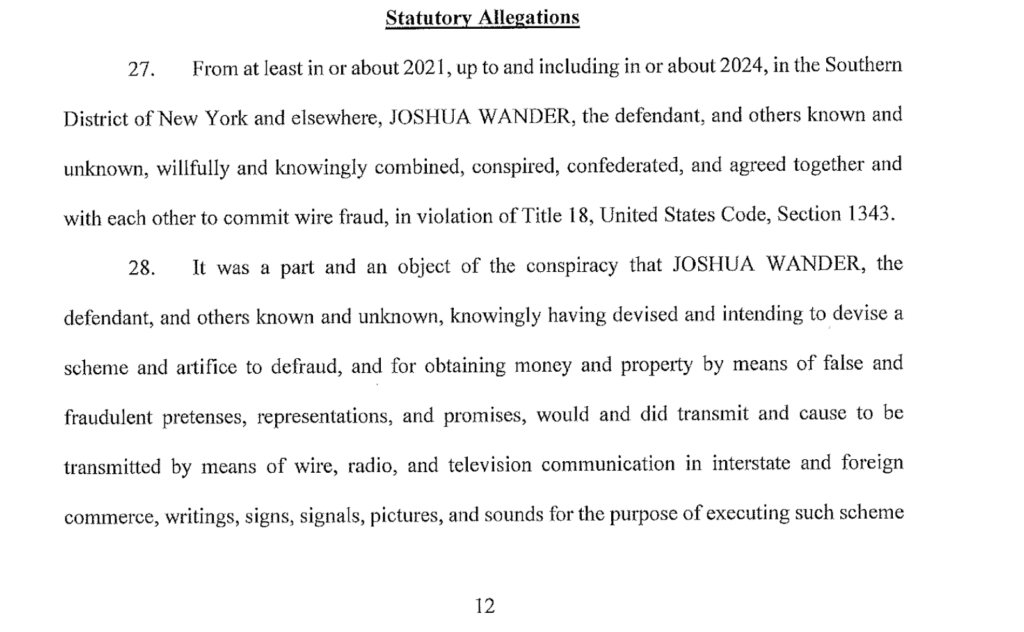

That allegation, made by UK lender Leadenhall Capital against King and A-CAP has yet to be tested in court, and is vehemently denied. While Wander has now been charged by the DOJ with conspiracy to commit wire fraud, wire fraud, conspiracy to commit securities fraud and securities fraud, nowhere in his indictment are either King or A-CAP mentioned.

Wander and two other 777 Partners executives, co-founder Steven Pasko and former Chief Financial Officer Damian Alfalla, were also charged by the Securities and Exchange Commission (SEC) for fraudulently soliciting investments in the Miami firm.

Both the DOJ indictment and SEC complaint list the lenders allegedly defrauded by 777 Partners anonymously. But Leadenhall have since identified themselves as one of the lenders referenced as a victim of the alleged fraud in both cases. By contrast, Josimar understands that A-CAP, whose executives were also subpoenaed as part of the criminal investigation which resulted in Wander’s indictment, are not among the lenders referenced as victims of fraud in either indictment. Therein, perhaps, lies the mystery.

If A-CAP were not, like Leadenhall, the victims of the alleged fraud, what were they?

In the civil case, the SEC wants a judge to force Wander and his fellow defendants to “disgorge all ill-gotten gains they received” and to “pay civil monetary penalties.”

But the penalties for Wander in the DOJ case are much more severe, as three of the charges against him carry a maximum sentence of 20 years in prison, with the fourth carrying a maximum sentence of five years in prison.

After surrendering himself to the authorities and posting his Miami condo to make bail, Wander was granted permission to spend Thanksgiving with his in-laws.

Meanwhile King, who continues to deny any wrongdoing, completed the purchase of an apartment in Greenwich Village on 5 November. With three bedrooms, four bathrooms and 2,592 square-feet (241 square metres) of space, it has significantly more room than Wander will be afforded should he be sentenced to jail time. King acquired the property via a new company, Seaver 41 LLC, which has the same Pleasantville, NY, mailing address as A-CAP and was registered in Delaware in July 2025. Documents seen by Josimar show that A-CAP’s Chief Legal Officer Jill Gettman was King’s “authorized signatory” for this transaction.

Kenneth King’s new home in the NoHo neighbourhood, Manhattan.

Inside Kenneth King’s new home.

Dubious ratings

Since Wander’s indictment, a number of new developments have occurred which help to shine a light on the relationship between 777 Partners and A-CAP.

Firstly, Bloomberg reported on November 6 that the SEC were probing the activities of Egan Jones, a small but prolific US credit ratings agency which graded over 3,000 investments in 2024 with a team of just 20 analysts. SEC enforcement attorneys are investigating whether Egan Jones executives “exerted improper commercial influence on its rating procedures.”

From 2019, A-CAP began loaning money to 777 Partners. It used premiums from its 250,000 insurance policyholders to do so. But it needed each loan to be designated “investment grade” to avoid falling foul of strict rules designed to protect these policyholders from undue risk. And it was Egan Jones which made this possible by rating much of the company’s lending to 777 Partners. This funding was subsequently funnelled into football clubs, budget airlines and other risky businesses which Wander’s firm had purchased. One of the airlines later went bust. The football clubs have required more and more funding from A-CAP ever since.

The Bank of International Settlements recently pointed to potentially “inflated assessments of creditworthiness” by small ratings agencies amid growing industry concerns around bad practice. In response to the Bloomberg article, an Egan Jones spokesman said the company “remains in good standing” with the SEC and is “dedicated” to serving clients. But the probe comes amid growing industry concerns around dubious ratings in the private credit space, with the Bank of International Settlements pointing to potentially “inflated assessments of creditworthiness” by small ratings agencies “which may face commercial incentives to assign more favourable ratings”.

In addition to the SEC probe into Egan Jones, new filings were made in cases involving both 777 Partners and A-CAP which also shed light on the relationship between the firms.

Liquidity Issues

We have always known that money was funnelled from A-CAP to 777 Partners in various ways. A-CAP insurers ceded at least 2.4 billion dollars-worth of insurance policyholder cash to 777 Partners via an offshore reinsurer in Bermuda, 777re, which later had its licence revoked. And a low-level holding company loan from A-CAP was amended and extended so many times that it ballooned to well over 750 million dollars. But a recent filing related to a litigation funding matter reveals, via a string of text messages between Wander and his then CFO Damien Alfalla, that as long ago as 2021, 777 Partners was also providing funding to A-CAP. At one point during the exchange, Alfalla writes: “Need to get $31m to A-CAP now to keep Carson at ease” and that “A-CAP has liquidity issues”, to which Wander replies “Ok” and “Yes they do.” Josimar understands Carson to be Carson McGuffin, an A-CAP portfolio manager.

Alfalla suggests that A-CAP needs the 31 million dollars “to pay off met”. Josimar understands this to refer to Metropolitan Partners, a New York private investment firm which has done business with A-CAP insurers. Wander later says that 777 Partners “need to give A-CAP more than $31m” and Alfalla replies “I know. This is to keep met from bothering A-CAP.”

Evidence that A-CAP was having “liquidity issues” as far back as 2021 raises questions about how long state regulators like Utah were aware the company may have been having problems. Tom Gober, a forensic accountant and certified fraud examiner who has spent 40 years focusing on the insurance industry, did independent research on the financial condition of A-CAP’s insurers that same year. He told Josimar: “I noticed that the five insurers involved in the A-CAP group were exhibiting some of the same symptoms related to affiliated paper and offshore reinsurance. Because affiliated investments are little more than IOUs between affiliates, and because substantial funds were leaving the companies to 777re, the insurers would of course be feeling a significant liquidity problem. When you have as high a level as ACAP companies did in affiliated transactions it creates an environment that is low in transparency, and that, coupled with the offshore reinsurance and excessive levels of affiliated paper, was significant enough for me to express concern to state regulators.”

Another filing, this time an update in the case mentioned earlier which precipitated the collapse of 777 Partners, sheds even more light on the intertwined relationship between the two companies.

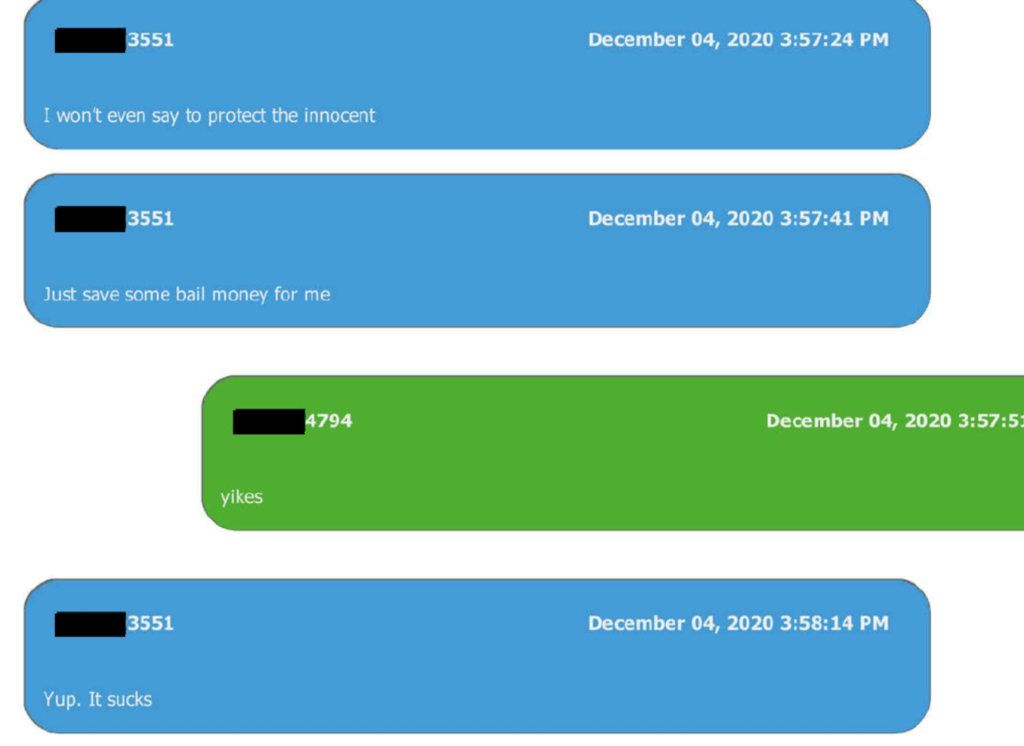

This time we have a string of messages exchanged between Alfalla and his 777 Partners colleague Jorge Beruff. In a message dated December 4, 2020, Alfalla says 777 Partners are “paying A-CAP $33m”. When Beruff asks where the money is coming from, Alfalla replies: “I won’t even say to protect the innocent” and “Just save some bail money for me.”

Alfalla then responds that it is “the wrong thing to do” to which Beruff replies: “Geez man, be careful.”

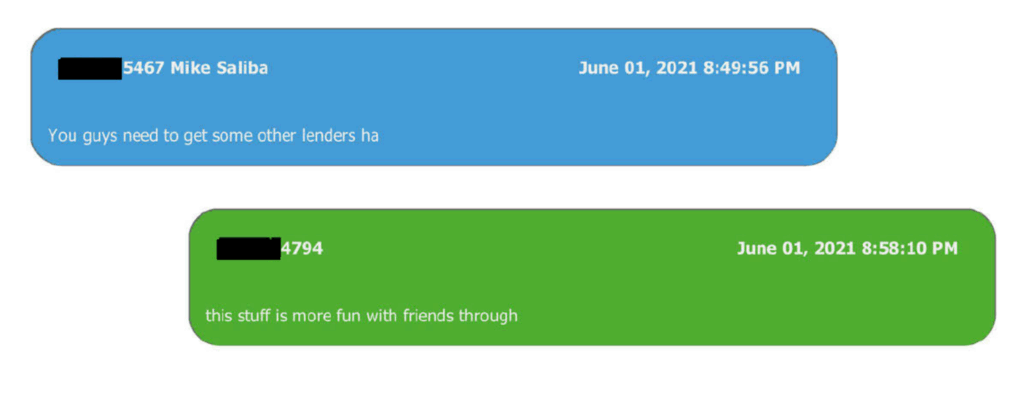

In another text exchange in the filing, this time from June 2021 between Beruff and Michael Saliba, A-CAP’s Chief Operating Officer, Beruff reveals that 777’s Asset Management arm was having “weekly calls” with A-CAP about “deal approvals” and that according to Saliba, “the most important person at A-CAP” is Jill Gettman, the company’s Chief Legal Officer. Gettman’s name is on all the legal paperwork related to an A-CAP entity called ACM Delegate which controlled their interests in 777’s football clubs. Saliba refers to her in the exchange as more important even than King. Leadenhall claimed in an October 28 letter to the judge in their civil case that, under orders from King, Gettman acted as a board member of entities created by A-CAP to take control of 777 companies or assets and that she was responsible for “installing and overseeing” restructuring firm B Riley to manage 777.

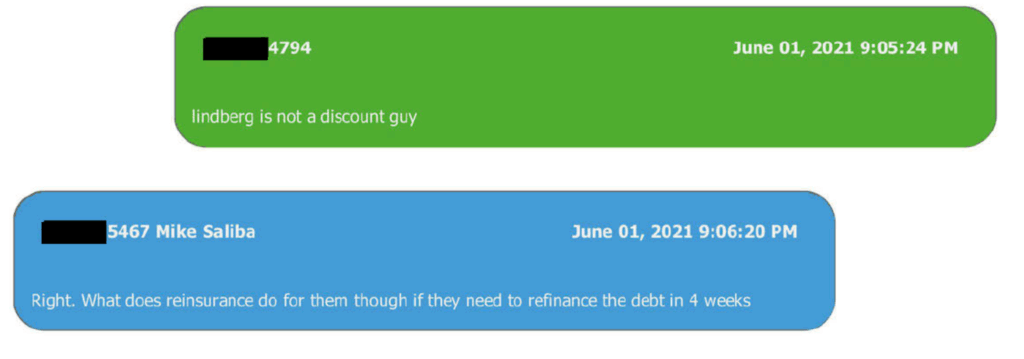

The closeness of the A-CAP/777 Partners relationship is underlined when Saliba writes: “You guys need to get yourself some other lenders ha” and Beruff replies: “This stuff is more fun with friends though.”

The pair then discuss how 777 Partners is doing business with a company called Global Growth, a private equity firm founded by convicted American insurance fraudster Greg Lindberg. Lindberg pled guilty in 2024 to a 2 billion dollars fraud and money laundering scheme which left thousands of policyholders and several insurance companies facing losses and received a 87-month jail sentence. He is later mentioned by name in the exchange.

Saliba then says: “I think that’s a deal we can help with” but it is unclear whether A-CAP ever did get involved.

However, Josimar can reveal that Lindberg already had relationships with A-CAP executives before 2021. For instance, in 2018, A-CAP’s portfolio manager Carson McGuffin, who we mentioned earlier, previously worked for Lindberg at Global Growth. In addition, an A-CAP affiliate owned by King called Ability Insurance was in talks over a business deal involving Lindberg before it was sold to a third party in 2021. Devin Solow, one of Lindberg’s alleged co-conspirators, was later deposed by the SEC and named McGuffin, King and other A-CAP executives in his testimony. He alleges that King requested Lindberg form an investment advisory firm in Malta called Standard Advisory Services Ltd (SASL) to “do a reinsurance deal with Ability Insurance.”

SASL was central to the Lindberg prosecution because both the SEC and DOJ alleged that it was used to direct money away from insurance policyholders, and that using Malta was a tax avoidance ploy. Solow also alleges that another A-CAP insurer, Atlantic Coast Life, entered into a reinsurance agreement with another Lindberg company called SNIC, and sent funds to SASL. Many of Lindberg’s investments were rated investment grade by Egan Jones, which as we mentioned above, went on to do ratings for A-CAP.

More indictments to follow?

Josimar has written before about a lawsuit in which King and an A-CAP colleague were accused of “engaging in a complex and massive fraud” resulting in losses for the plaintiff exceeding 135 million dollars (they deny wrongdoing). We also wrote about how, in March 2025 it looked like King would lose control of three of his insurers when the Utah Insurance Department petitioned a judge to seize control of them. Utah claimed the three companies had become insolvent as a result of their losses on loans to 777 Partners, and that King and other A-CAP employees “directly and improperly benefitted from those investments” via management fees, a Miami condo, mortgage loans and “compensation paid directly to A-CAP”. But this petition was withdrawn after the two sides reached a sudden settlement. The details of the settlement have not been made public, and when Josimar sent questions to Utah about it, they went unanswered.

The criminal indictment against Wander states that he was engaged in a scheme to “defraud lenders and investors” from “at least 2021 up to 2024”. An FBI press release says that scheme “began to unravel” by March 2023. From April 2023 onwards, Josimar has seen evidence that A-CAP executives including King, Gettman and Saliba all became active members of a 777 Partners “steering committee”. This committee was directly involved in investment decisions, cost control measures, payment of expenses to subsidiaries and payment of bills to vendors, with King often given the final say in his role as 777’s biggest creditor. Leadenhall claim in their lawsuit that by the end of 2023, A-CAP executives had “physically moved into 777’s Miami offices to oversee Wander and Pasko’s operations” and in their letter to the court on October 23, they write: “As the SEC complaint and indictment underscore, Wander did not act alone.” In response, lawyers for A-CAP wrote that Leadenhall’s letter was “an obvious attempt to defame A-CAP and Mr. King”. The response continues, saying that: “none of the actions name Kenneth King or A-CAP. Mr. King and A-CAP have not

been indicted. The government actions do not reference Mr. King or A-CAP by name or even suggest that they are implicated in any way; they are not. Plaintiffs’ suggestion to the contrary is not a misunderstanding; it is a deliberate distortion of the public record and a desperate attempt to weaponize government filings to smear Mr. King and A-CAP.”

Wander is the only member of 777 to so far be charged with criminal offences. Two others, Alfalla and firm co-founder Steven Pasko, were charged along with him in the SEC’s civil complaint – and both co-operated with law enforcement. But the criminal complaint against him states that Wander “and others known and unknown” conspired together to commit the offences he was charged with. It remains to be seen, then, if more indictments will follow.